The Search Fund life cycle

In recent years, Search Funds have experienced a surge in popularity, it is hard to overlook the successful results they have generated. There have been an impressive number of Search Funds raised, acquisitions made, and new investors have been appearing continuously.

Table of contents:

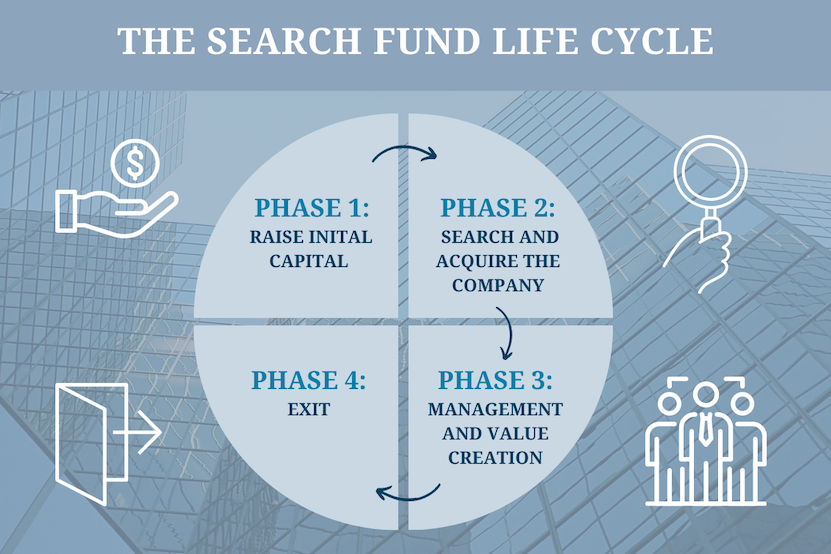

Let’s talk about the four phases in the Search Fund life cycle:

The life cycle of a Search Fund is the vital core of the Search Fund’s operational model.

To launch a Search Fund, searchers must raise enough capital to cover search costs and conduct seller outreach to find potential target businesses. Due diligence is conducted on a potential investment before negotiating a purchase with sellers and raising acquisition capital.

After a successful acquisition, the searchers become the new CEOs with the goal of increasing the company’s value and exiting for a profit.

Phase 1: Raise initial capital (2-6 months)

The Search Fund process begins with raising initial capital. This can take anywhere from 2 to 6 months.

As an entrepreneur looking to acquire a company, you’ll need to secure the funding of your search: Search capital covers the expenses of searching for the right acquisition, including a salary, administrative costs, over a two-year period, and due diligence expenses over a two-year period.

Searchers are typically expected to raise enough capital to cover all the expenses related to finding and acquiring a business. The initial capital can come from a variety of sources, including family and friends, angel investors or institutional investors.

In this initial phase, the entrepreneur may wish to create a business plan. This should outline their experience, skills, and vision for the business they want to acquire. Within this plan, it’s recommended to present financial projections and details on the type of business they want to acquire such as the size, industry and geographic location.

Phase 2: Searching and acquiring the company (12-24 months)

The search for the right acquisition can take up to 24 months. This involves a systematic approach to create deal flow and analysing opportunities to identify and close a successful acquisition. Entrepreneurs who focus their search by researching the market and identifying potential businesses that meet specific criteria are more likely to find and close a successful acquisition.

Usually, the entrepreneur sets up a search team comprising professionals such as industry experts, accountants, and lawyers, to assist in identifying suitable acquisition targets.

Once you’ve identified a target acquisition and negotiated a deal, it’s time to reach out to the owners to gauge their interest in selling. If the owner is interested, the entrepreneur conducts further due diligence to evaluate the business’s financials, operations and legal structure.

Phase 3: Management and value creation (4-7+ years)

Once the entrepreneur has identified a suitable business to acquire, they negotiate with the owner to acquire the business. This involves conducting further due diligence to confirm the initial assessment and identify any potential risks or issues. Subsequently, the entrepreneur will structure the deal, involving cash payments, equity, or a combination of both.

Within the first 6-18 months, the searcher will make necessary changes to improve the functioning of the business. This period is critical for creating value through revenue growth, improving operating efficiency or multiple expansions.

The long-term success of the business depends on the searcher’s ability to identify and capitalise on growth opportunities while simultaneously managing the challenges that come with running a business.

Phase 4: Exit (6 months)

The final stage of the Search Fund process is the exit stage. This can typically occur after 5 years or more. This stage involves preparing the business for sale, finding a buyer, negotiating the sale, closing the deal and distributing the proceeds to the investors. The entrepreneur must first prepare the business to maximise its value before finding a suitable buyer. Once a buyer is found, they can negotiate the terms of the sale and complete the deal with the help of legal and financial advisors. Finally, the entrepreneur distributes the proceeds to investors according to a predetermined structure.

At ONEtoONE Great Searchers Fund, we invest in exceptional Searchers to become the next generation of great leaders.

Whether you are already a Searcher or are looking to become a Searcher, we are here to support you. We finance your search, invest in the acquisition, empower you to build a great business, and help you exit successfully, with our sole purpose being to devote our time to ensuring your success.