5 bubbles and 1 opportunity

The Economy and financial markets have been fueled by the gasoline of cheap credit and the oil of financial engineering.

Ultra-low interest rates have boosted corporate profits (by reducing financing costs), boosted household consumption and allowed governments to over-indebt and increase spending.

The sum of the increase in profits, consumption and public spending has created a battery of bubbles. Never before in history have there been so many bubbles. In 1998 we had the Stock Market bubble; in 2000, we had the startup bubble, and in 2007 we had the Real Estate bubble. Now we have five.

1. We have a Stock Market bubble

The S&P 500 is up 27% in 2021, reaching the historical price/earnings ratio (P/E) of 27 times. In other words, you have to wait 27 years to get your money back and start earning a return. This is an outrage. At some point, investors will stop being willing to buy at those prices and sales will be unleashed.

2. We have a housing bubble

Housing has risen four times more than family salaries in the last five years. Today it takes 7.1 years of a family’s salary to pay for their home.

This housing bubble is co-occurring in Europe, the United States, the UK, Australia, particularly acutely, China.

3. There is a Bond Bubble

Zero rates have driven 80% of sovereign bonds in Europe to negative rates. The fear of inflation puts upward pressure on the yield curve and may lead to a wave of bond selling, causing the bubble to burst.

4. There is a commodity bubble

The strong demand for products (in the face of the decline in services due to confinements, restrictions or temporary closure of companies) and the shortage of containers and ships (with transport prices multiplied by six) has triggered the price of raw materials such as copper, iron, oil, gas, platinum, tin, corn, soybeans and all kinds of grains, disrupting companies’ profit and loss accounts and triggering inflation.

5. And a startup bubble

One of the newer bubbles, there is a new craze in startup valuations that reminds us of the dot-com bubble of 1999. Irrational valuations are back, with the words metaverse, crypto, fintech or cybersecurity alone generating investor anxiety. Investors are writing bigger and bigger checks, and unicorns are multiplying.

Warren Buffet said: “I like to buy quality products when they are discounted“. It seems clear that these five asset classes are not.

So which of the bubbles should I invest in?

If the Stock Market is expensive, Real Estate assets are expensive, startups are impossible, and bonds give pitiful returns. On top of that, they charge me for having money in the bank; what’s left are private and unlisted companies. There is a universe of opportunities to fish for there.

From 3 million Ebitda upwards, there are thousands of companies in which private equity firms are already trying to buy them, which has caused them to be expensive and yields to suffer.

But there are many opportunities below.

In Europe, there are hundreds of thousands of companies with EBITDA between 1 million and 3 million euros (where private equity firms l does not enter), of which 17% of the owners have no succession.

While companies are listed on the S & P at 18 times EBITDA, these private companies are bought more than 70% cheaper on average. Their free cash flows are the same (euros), albeit on a smaller scale, which mathematically leads to double the profit possibilities. This is value investing.

At the same time, many young, highly prepared managers are eager to leave the yoke of the big company and become entrepreneurs by taking the lead in one of these SMEs. That is why there are more and more Search Funds in the market, and more and more investors want to invest in SMEs together with these Searchers to buy them and increase their value.

Buffet also said: “Buy a company because you want to own it, not because you want the stock to go up“. Well, in this segment of SMEs there are great opportunities: companies without debt, with proven businesses, cash generators, with wide EBITDA margins, with a diversified portfolio of clients, in sectors that are growing and with ample capacity for improvement in management; many of them need to sell because the entrepreneur is older and has no succession.

There are many of these opportunities. There is only a lack of bright young people who want to buy them to take them, with new blood, to the next dimension and investors to finance them.

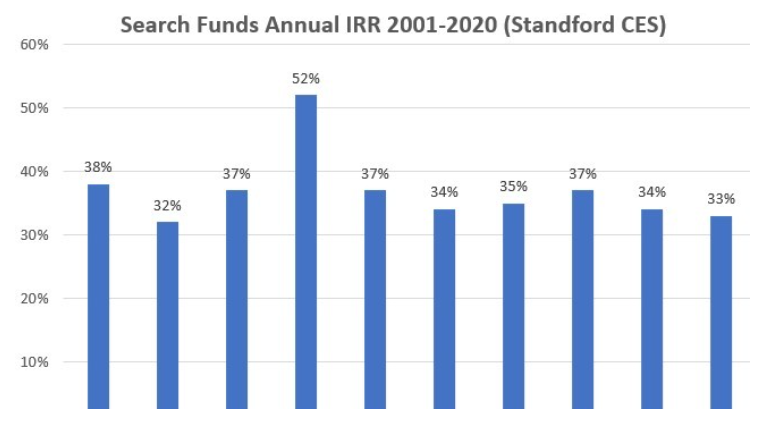

In the USA, there are already many Funds specialized in investing in Searchers and, through them, in these solid, profitable SMEs whose owner has no succession. These funds are producing astonishing average returns: around 30% per year(see graphic above).

In Europe, we will see them very soon because the need, opportunity, and profitability are waiting for investors to take it.

At ONEtoONE Great Searchers Fund, we invest in exceptional Searchers to become the next generation of great leaders.

Whether you are already a Searcher or are looking to become a Searcher, we are here to support you. We finance your search, invest in the acquisition, empower you to build a great business, and help you exit successfully, with our sole purpose being to devote our time to ensuring your success.